What is TradeLyser?

Introduction

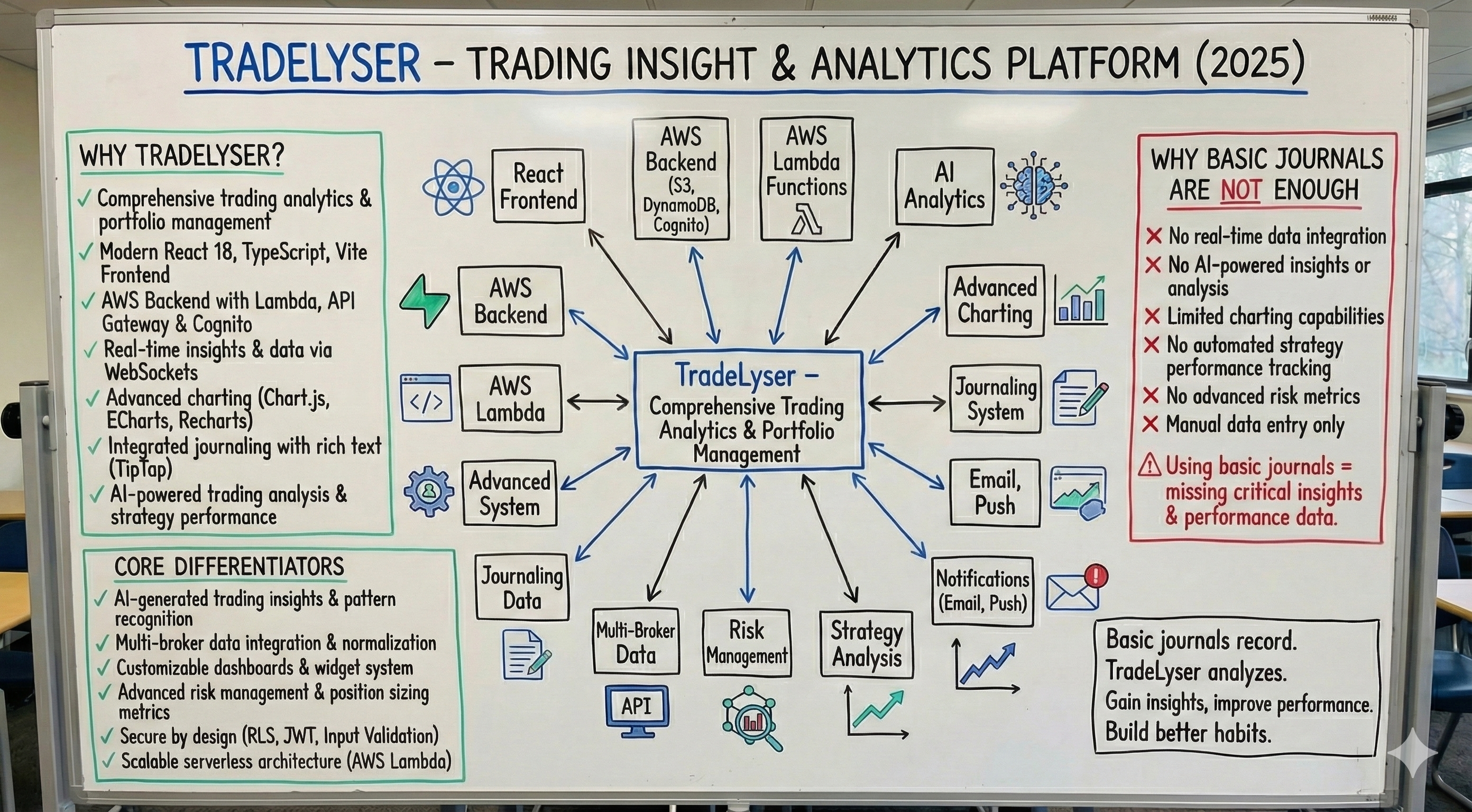

TradeLyser is an AI-powered trading journal and performance analytics platform built specifically for the Indian stock market. It transforms raw trade data into intelligent, actionable insights, helping traders improve consistency, discipline, and decision-making through data-driven analysis.

Think of TradeLyser as your always-on trading performance coach—automatically tracking every trade, using AI to detect patterns, highlight behavioral mistakes, evaluate strategy quality, and clearly show what’s working and what’s not across Indian market instruments.

The Problem TradeLyser Solves

Most Traders Are Flying Blind

The uncomfortable truth about trading:

- 90% of traders lose money—not because they lack knowledge, but because they lack awareness

- Mistakes keep repeating—without systematic tracking, the same errors drain accounts month after month

- Emotions override strategy—fear and greed cloud judgment when there's no objective data to guide decisions

- No clear improvement path—without tracking, it's impossible to know what to fix or what's working

Most traders treat trading like gambling. They remember their big wins, conveniently forget their losses, and have no clear picture of their actual performance. They trade on gut feeling, repeat costly mistakes, and wonder why they're not improving.

The bottom line: You can't improve what you don't measure.

What TradeLyser Does

TradeLyser brings professional-grade trading analytics to every Indian trader, making it simple to:

1. Track Everything Automatically

No more manual spreadsheets or memory-based trading. Connect your broker account and TradeLyser automatically:

- Imports all your trades from 20+ Indian brokers

- Organizes orders into completed trades

- Calculates P&L, charges, and taxes automatically

- Updates your equity curve in real time

- Maintains a complete, audit-ready trade history

Supported Brokers: Zerodha, Dhan, Fyers, Angel One, Upstox, 5Paisa, Alice Blue, Groww, ICICI, HDFC, Kotak, and more.

2. See What’s Really Happening

Get crystal-clear visibility into your true trading performance—not just profits, but process.

Performance Metrics

- Net P&L and ROI

- Win rate and profit factor

- Average win vs average loss

- Maximum drawdown

- Risk-adjusted returns (Sharpe ratio)

- Trade expectancy

Pattern Analysis

- Which strategies consistently make money

- Your best and worst instruments

- Time-based performance (days, sessions, expiry cycles)

- Rule adherence vs profitability

- Highest-probability setups and conditions

No opinions. No excuses. Just facts.

3. Get AI-Powered Insights

Meet Elysia, your AI trading assistant built for Indian markets.

Ask questions in plain English and get instant, data-backed answers:

- "What’s my win rate on NIFTY this month?"

- "Where am I losing money repeatedly?"

- "Compare my intraday vs swing trading performance"

- "When do I trade most profitably?"

Elysia understands 28+ query types with 500+ natural language variations, delivering:

- Performance summaries

- Pattern detection

- Behavioral bias analysis

- Optimization suggestions

- Next-best action insights

4. Improve Systematically

TradeLyser doesn’t just show numbers—it builds discipline.

Rule Tracking

- Define personal trading rules (risk, entries, sizing, exits)

- Track discipline and rule violations

- See correlation between rule-following and profitability

- Get alerts when rules are broken

Strategy Book

- Document and version trading strategies

- Track performance by strategy

- Compare strategies side by side

- Eliminate what doesn’t work and scale what does

Journaling

- Add context to every trade

- Tag trades by setup, strategy, or market condition

- Rate trade quality (A+ to D)

- Review historical patterns and lessons learned

Progress Tracking

- Measure month-over-month improvement

- Set goals and track execution

- Build a personal trading playbook

- Develop a repeatable trading edge

5. Backtesting & Strategy Validation

Test ideas before risking real capital.

- Backtest strategies on historical Indian market data

- Validate setups across different market conditions

- Analyze drawdowns, win rates, and expectancy

- Compare multiple strategy variants

- Bridge the gap between theory and live execution

6. Mentor–Mentee Module

Designed for structured learning and trading education.

- Mentors can review mentee trades and journals

- Share strategies, rules, and playbooks

- Track mentee progress using objective metrics

- Identify recurring mistakes and behavioral gaps

- Enable data-driven mentorship and accountability

7. Investor & Portfolio Module

Built for long-term investors alongside active traders.

- Track equity, mutual fund, and long-term portfolios

- Monitor asset allocation and concentration risk

- Analyze returns vs benchmarks

- Review holding periods and drawdowns

- Get a unified view of trading and investing performance

Document Version: 1.0

Last Updated: October 26, 2025